Understanding Swiss Taxes

Clear explanations and practical insights for navigating the Swiss tax system.

Hiring in Switzerland: What UK Businesses Need to Know

This guide explains how UK companies can legally and efficiently hire talent based in Switzerland under the new bilateral social security treaty, along with key tax considerations to keep in mind.

Hiring in Switzerland: What EU Businesses Need to Know

This guide explains how companies based in EU/EFTA countries can legally and efficiently hire talent based in Switzerland under 2025 EU and Swiss regulations, while also addressing the relevant international tax considerations.

Hiring in Switzerland: What US Businesses Need to Know

This guide outlines how US companies can legally and efficiently hire Swiss-based talent by navigating local employment, tax, and social-insurance regulations to ensure compliance and cost-effectiveness.

Understanding Swiss Withholding Tax (Quellensteuer/Impôt à la source) – A 2025 Update

This guide explains Switzerland’s withholding tax system for foreign employees, covering its application, transition to ordinary taxation, and strategies for optimization and refund.

Moving to Switzerland in 2025: Your Essential Handbook for Swiss Residency, Taxes, and Financial Planning

This guide serves as your essential handbook for relocating to Switzerland in 2025, covering all the fundamental information you need—from residency permits (L, B, C) and tax residency rules to filing deadlines, important deductions, and practical tax optimization strategies.

Tax Deadlines in Switzerland 2025: Key Dates & Extension Policies

This guide provides an overview of the 2025 tax deadlines for most Swiss cantons, outlining key dates, extension policies, and important considerations for taxpayers.

Managing Healthcare Costs & Autism in Switzerland: A Tax Perspective

Managing healthcare costs in Switzerland can be challenging, but understanding tax deductions for health insurance premiums, medical expenses, and autism-related therapies can help reduce financial burdens.

Wealth Tax in Switzerland

Understand Switzerland’s wealth tax, including cantonal differences and exemptions. Discover expert tips for optimizing your tax obligations with Taxolution.

Tax Payments in Switzerland

Anyone who is liable to pay taxes in Switzerland and has to file a tax return at the end of the tax period may ask themselves how the taxes have to be paid.

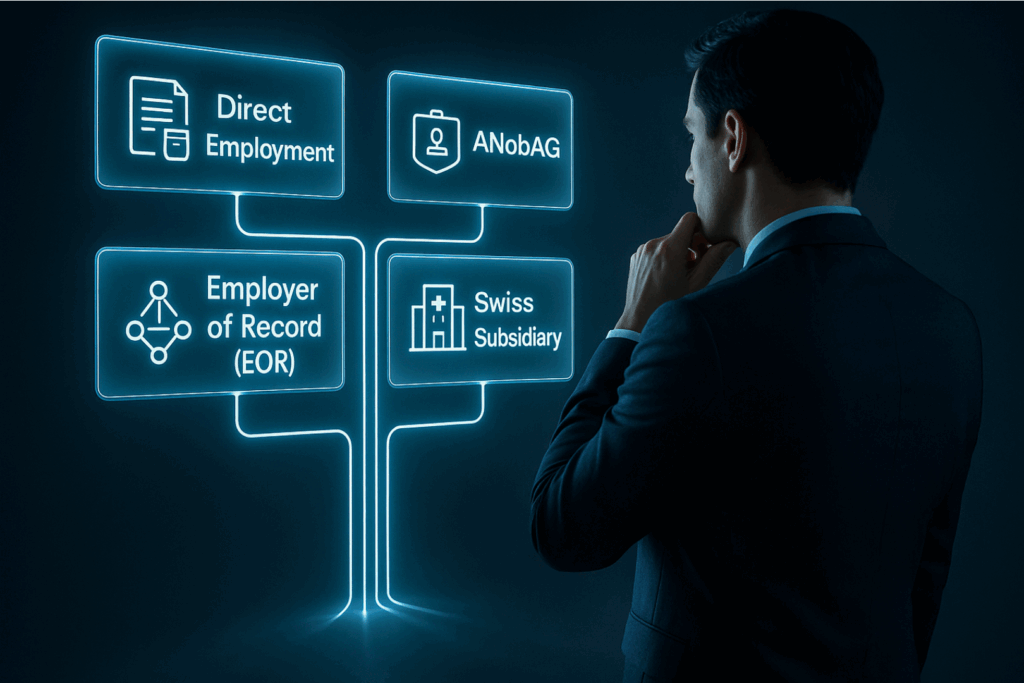

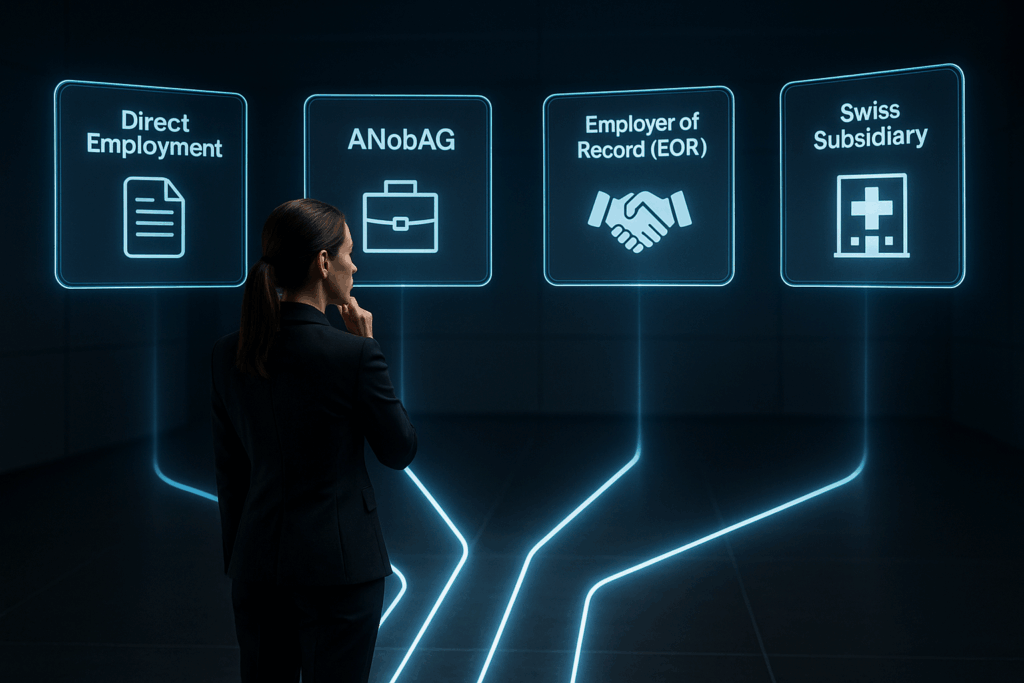

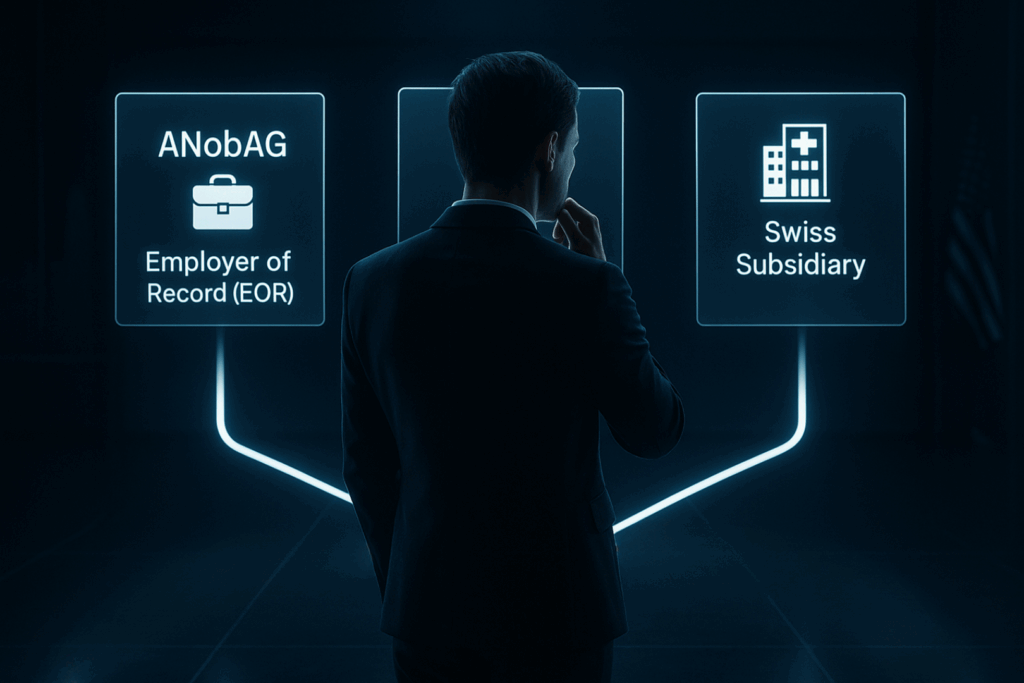

International Work Arrangements in Switzerland

This complete guide assists you in understanding and choosing the right legal and tax structures for your international employment in Switzerland, including direct or indirect employment models like ANobAG and EU-employments, self-employment registrations, and setting up subsidiaries and company branches.

Switzerland and Russia: Financial Relations, Sanctions, and the Suspension of the Double Taxation Agreement

Switzerland’s financial relationship with Russia is multifaceted, encompassing various aspects from financial sanctions to investment activities. Recently, a new dimension has been added to this complex relationship.

Wealth Exodus: Billionaires Leave Norway in Response to Rising Taxes

The government of Norway has introduced stricter rules for taxing and a lot of the country’s billionaires have moved. Why do they come to Switzerland?