Tax Payments in Switzerland

Navigating the Swiss tax system can be a complex affair, given its multi-level structure of federal, cantonal, and municipal taxes. This guide aims to simplify the process, outlining the mechanisms for tax payments in Switzerland.

How Are Taxes Paid in Switzerland?

In Switzerland, the tax system is structured across three levels – federal, cantonal, and municipal – each with its own set of rules and rates, adding layers of complexity for those unfamiliar with the system.

Federal Tax

Federal taxes on individual income are collected by the cantons and forwarded to the federal government. These taxes are due in a lump sum by the end of March following the tax period, based on rates derived from cantonal and municipal levels.

Cantonal Tax

Cantonal taxes vary significantly across Switzerland, with each canton setting its own rates. Cantons have the freedom to levy taxes on income and wealth, subject to federal constraints.

Municipal Tax

Municipal taxes are also levied on income and wealth, within the limits set by cantonal law.

Paying Taxes by Type of Assessment

Generally, two processes are distinguished that are crucial to the way taxes are paid.

Subsequent Ordinary Assessment in the Case of Taxation at Source

Anyone who pays withholding tax and has to submit a tax return at the end of the tax period will subsequently receive the tax assessment in the form of a final invoice (applies to taxpayers obligated to file a tax return or opt-in to do so). Depending on the tax burden determined, a refund is then made for excess taxes paid or the taxpayer must make an additional payment.

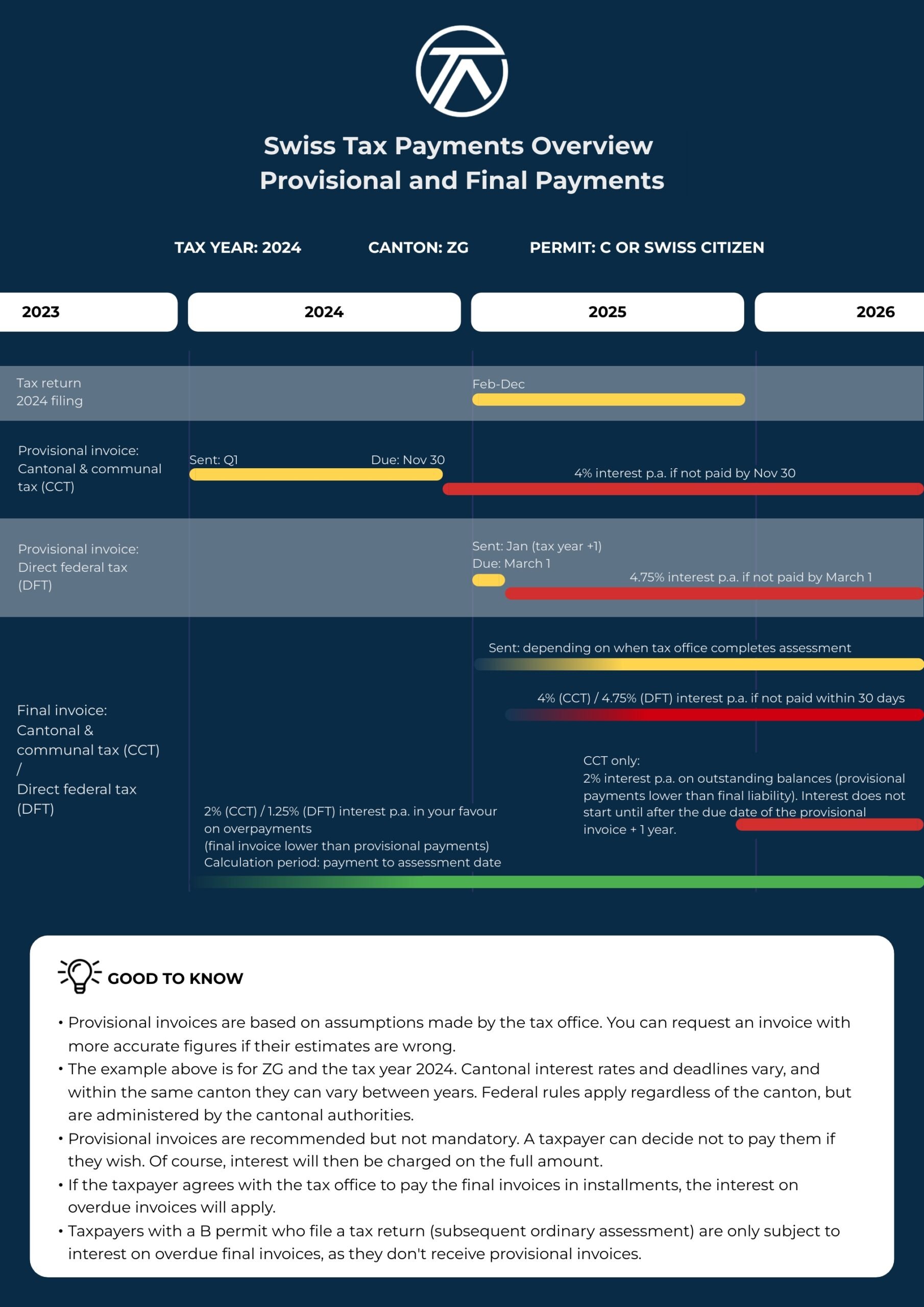

Ordinary Assessment With Provisional Invoice

Anyone who does not pay withholding tax, i.e. is subject to regular assessment, receives provisional invoices for cantonal and municipal tax from the tax authorities during the current tax year. The taxpayer then pays a provisional tax on the due dates specified.

At the end of the tax period, the taxpayer fills out his tax return, the tax authority then determines the actual tax burden in the past year and prepares a final invoice by offsetting the taxes already provisionally paid against the total tax burden.

Refined Understanding of Provisional Tax Payments

In Switzerland, the tax year aligns with the calendar, starting on January 1 and concluding on December 31. During this period, taxpayers receive provisional invoices based on their previous year’s income or assets. These invoices serve as a prelude to the final tax assessment, offering an estimate of the tax liability for the current year.

Interest Mechanisms Explained

- Default Interest

This interest is applicable when taxpayers do not meet the payment deadline for a provisional invoice or the final tax invoice. It’s crucial to note that even though provisional payments aren’t mandatory, default interest will still apply if the deadlines set by these invoices are missed. This mechanism ensures that taxpayers are incentivized to adhere to the payment schedules provided by the tax authorities. - Compensatory Interest

This interest comes into play when there’s a difference between the provisional payments made and the actual tax liability determined by the final invoice. If a taxpayer has overpaid based on the provisional invoices, compensatory interest is awarded on the excess amount, calculated from the payment date until the final assessment is issued. This interest rewards taxpayers for their advance payments and aligns with the principle of fairness in the tax system.

Interest for Late Payment

| Canton | Interest for Prepayment 2023 | Default Interest 2023 | Interest for Prepayment 2024 | Default Interest 2024 |

|---|---|---|---|---|

| Aargau | 0.30% | 5.00% | 0.75% | 5.00% |

| Appenzell Ausserrhoden | 0.20% | 5.00% | 0.20% | 5.00% |

| Appenzell Innerrhoden | 1.00% | 4.50% | 1.00% | 4.50% |

| Basel-Landschaft | 0.20% | 5.00% | 0.80% | 4.75% |

| Basel-Stadt | 0.50% | 3.50% | 1.00% | 3.50% |

| Bern | 0.25% | 3.00% | 1.00% | 4.00% |

| Freiburg | 0.00% | 3.00% | 0.25% | 3.00% |

| Genf | 0.50% | 3.00% | 0.50% | 3.00% |

| Glarus | 0.00% | 4.50% | 1.00% | 4.50% |

| Graubünden | 0.00% | 4.00% | 0.75% | 4.00% |

| Jura | 0.00% | 5.00% | 0.75% | 5.00% |

| Luzern | 0.00% | 3.50% | 1.25% | 4.75% |

| Neuenburg | 0.00% | 8.00% | 0.00% | 3.50% |

| Nidwalden | 0.10% | 4.00% | 1.00% | 4.75% |

| Obwalden | 0.10% | 5.00% | 1.10% | 5.00% |

| Schaffhausen | 0.10% | 4.00% | 0.10% | 4.00% |

| Schwyz | 0.50% | 3.50% | 1.00% | 3.50% |

| Solothurn | 0.00% | 3.00% | 0.00% | 3.50% |

| St. Gallen | 0.25% | 4.00% | 1.00% | 4.00% |

| Tessin | 0.10% | 2.50% | 0.10% | 3.50% |

| Thurgau | 0.20% | 3.00% | 1.00% | 4.00% |

| Uri | 0.25% | 4.00% | 1.00% | 4.50% |

| Waadt | 0.00% | 4.00% | 0.33% | 4.75% |

| Wallis | 0.00% | 3.50% | 0.00% | 3.50% |

| Zug | 0.00% | 4.00% | 2.00% | 4.00% |

| Zürich | 0.25% | 4.50% | 1.00% | 4.50% |

Strategic Considerations for Taxpayers

The structure of provisional and final tax assessments, coupled with the default and compensatory interest rates, prompts taxpayers to strategically manage their payments. Early payments can be advantageous, especially in a financial environment where compensatory interest rates might offer better returns than traditional saving methods. However, taxpayers must also be cautious about the deadlines for provisional and final payments to avoid the accrual of default interest.

Managing the Final Tax Payment

In the Swiss tax system, while provisional invoices are subject to default interest if not paid by their respective deadlines, it’s the final tax invoice that holds significant enforceability. This distinction is crucial for taxpayers to understand as the final invoice not only triggers default interest for late payments but also carries legal obligations for payment.

Enforceability of the Final Tax Invoice

The final tax invoice, issued after the reconciliation of provisional payments and actual tax liability, is legally binding. Unlike provisional invoices, which provide an estimate and encourage taxpayers to manage their tax payments throughout the year, the final invoice represents the definitive tax obligation. Failure to settle this invoice by the deadline can lead to more severe consequences than just the accrual of default interest.

Legal Implications and Fines

In addition to default interest, which is higher than compensatory interest for provisional invoice overpayments, late payment of the final invoice can result in legal action by tax authorities. This action may include fines and enforcement measures such as garnishment of wages. The enforceability of the final invoice underscores the critical nature of meeting this financial obligation on time.

Taxpayers are advised to prioritize the settlement of the final invoice to avoid these additional financial burdens and legal complications. In cases of financial difficulty, engaging proactively with tax authorities can provide options such as payment extensions or installment plans, helping to manage the payment of taxes in a more feasible manner.

How Does the Collection of Back Taxes Work?

If the taxpayer does not pay the demanded taxes even after a reminder, the tax authority may initiate enforcement proceedings, which is also called debt collection.

The taxpayer receives a payment order and has the right to raise a legal objection against the debt collection, which initially interrupts it. In the subsequent legal proceedings, the taxpayer can only avert the debt collection if he can justify that the tax claim has already been paid, waived or deferred, or is already time-barred.

If the legal proposal is invalidated, the debt collection procedure is continued. In this case, an attachment is immediately made, either on the income or other types of income of the taxpayer.

Do you have further questions about taxation in Switzerland? Contact us for a non-binding quote. We will contact you promptly and discuss your individual situation.