Premium Advisory Services

We help expats navigate the Swiss tax system effectively.

Join Over 1,000 Clients With Our Swiss Tax Services

- Unlock Maximum Tax Savings

- Coverage for Every Canton

- Optimization Recommendations After First Call

- English-Translated Tax Return to Counter Language Gaps

- 100% Digital Filing Through Our Tax Portal

The Easiest Way To File Swiss Tax Returns

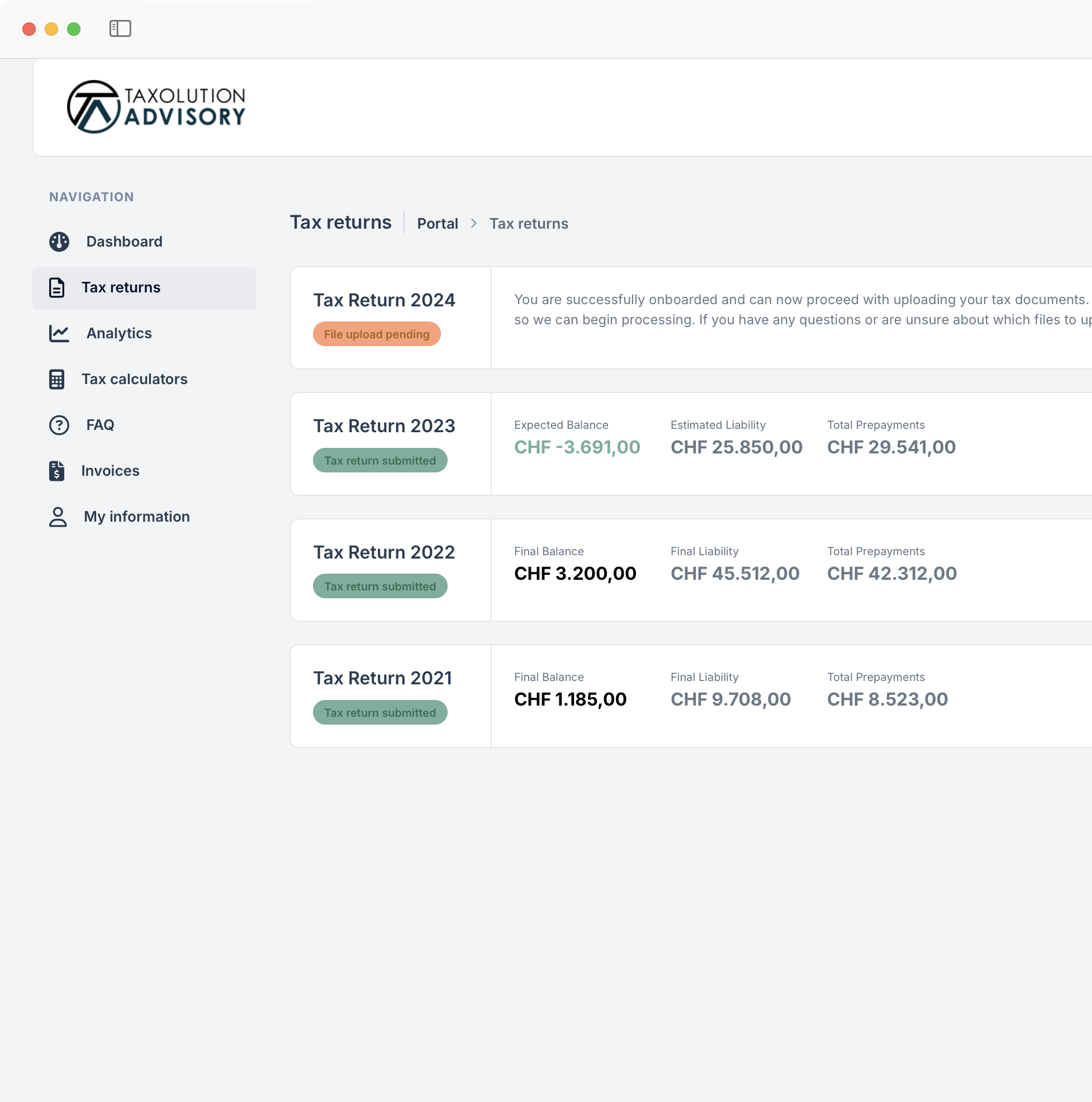

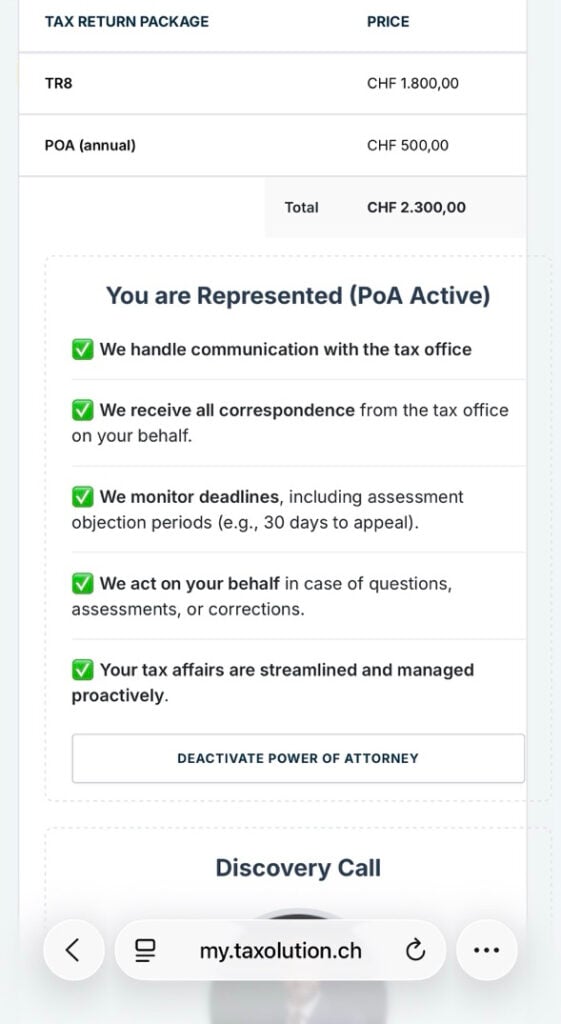

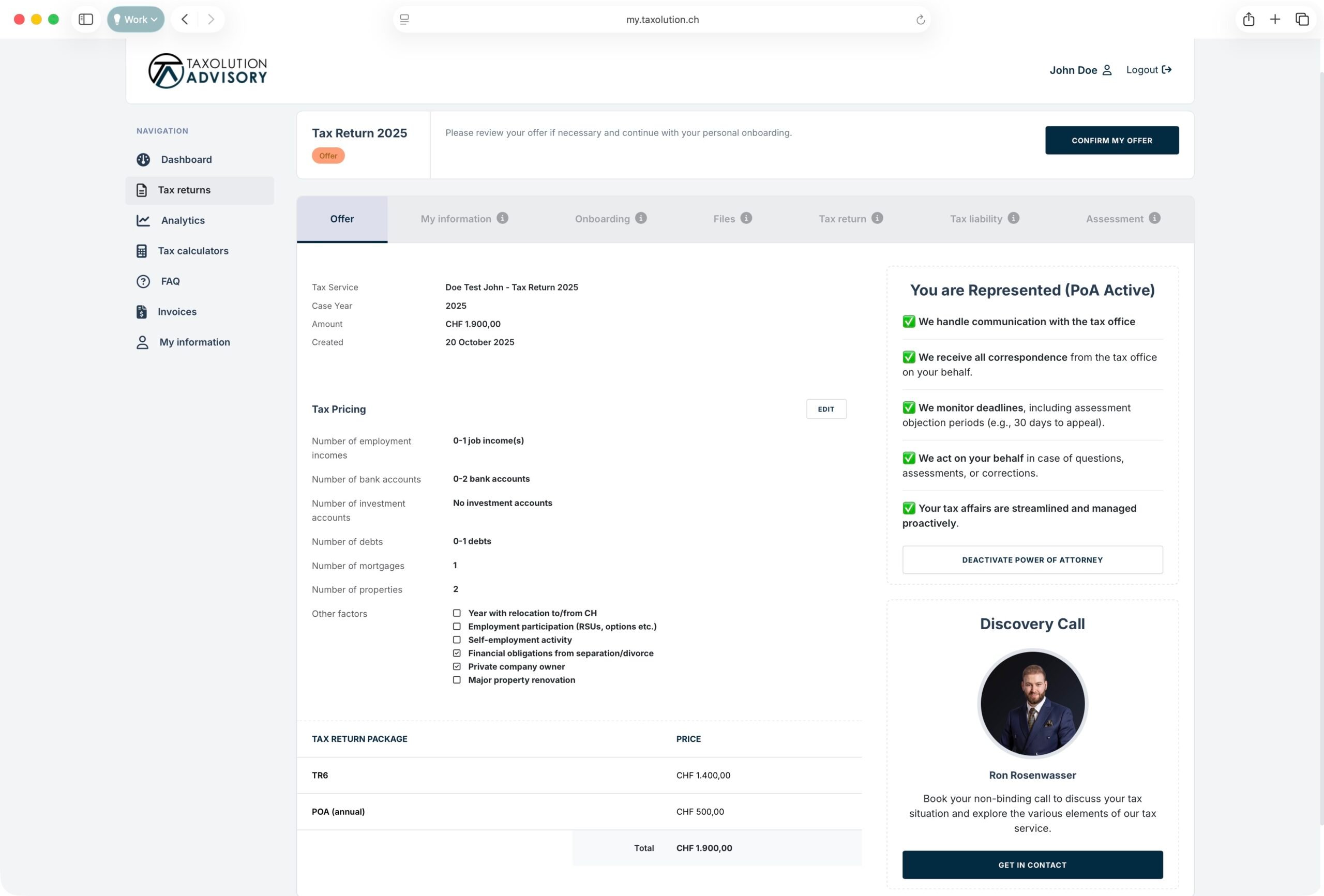

The MyTaxolution web portal simplifies the tax return filing process, ensuring it’s easy to do and providing greater clarity for expats navigating Swiss taxes.

Simple Pricing

Obtain an accurate price quote in just a few clicks.

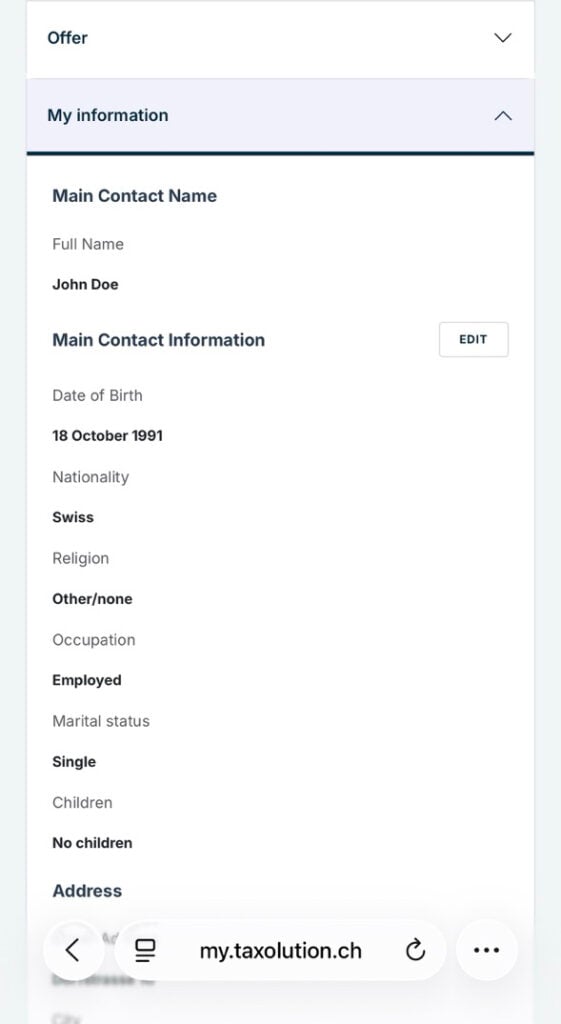

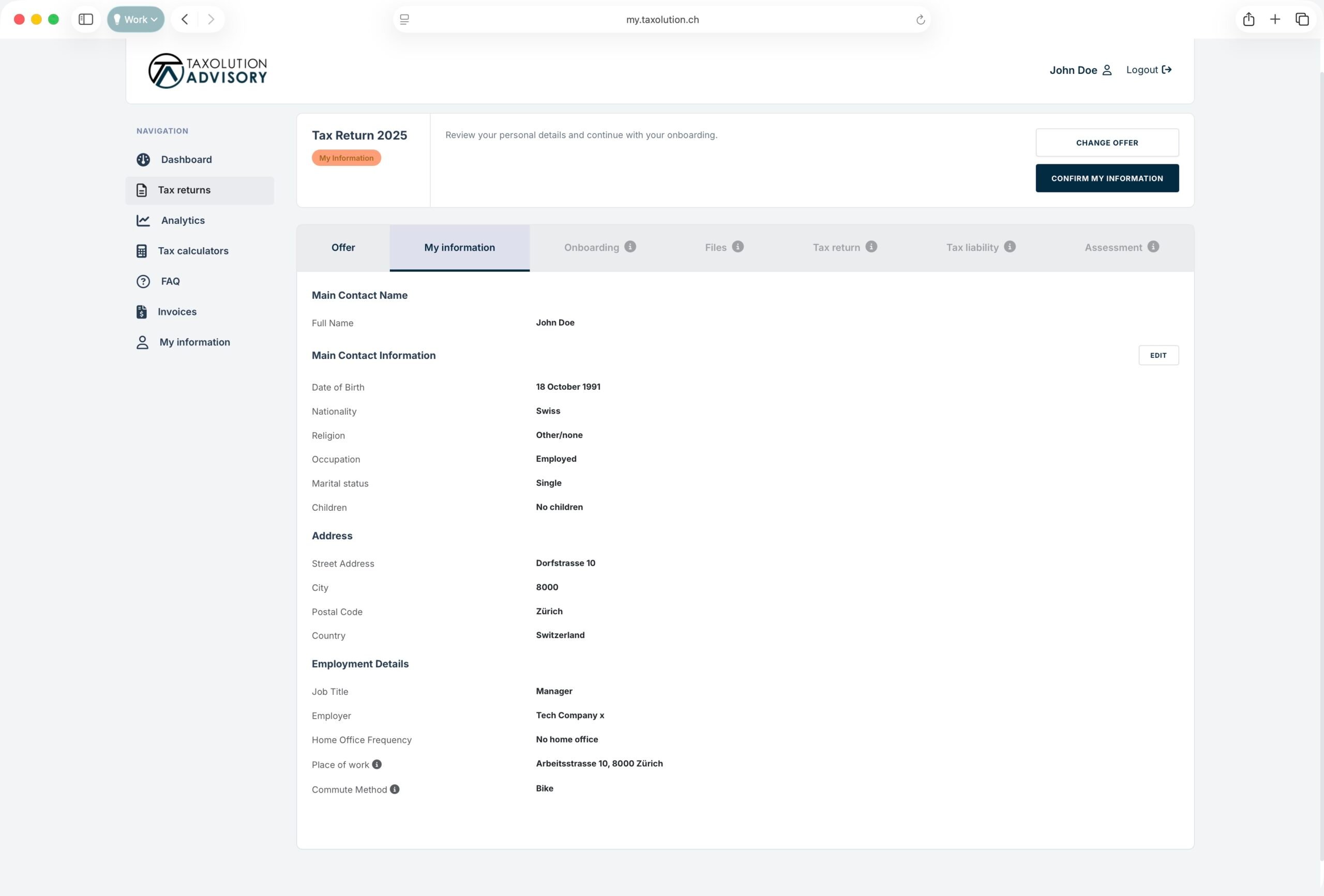

Control Your Data

Your personal details are always up to date.

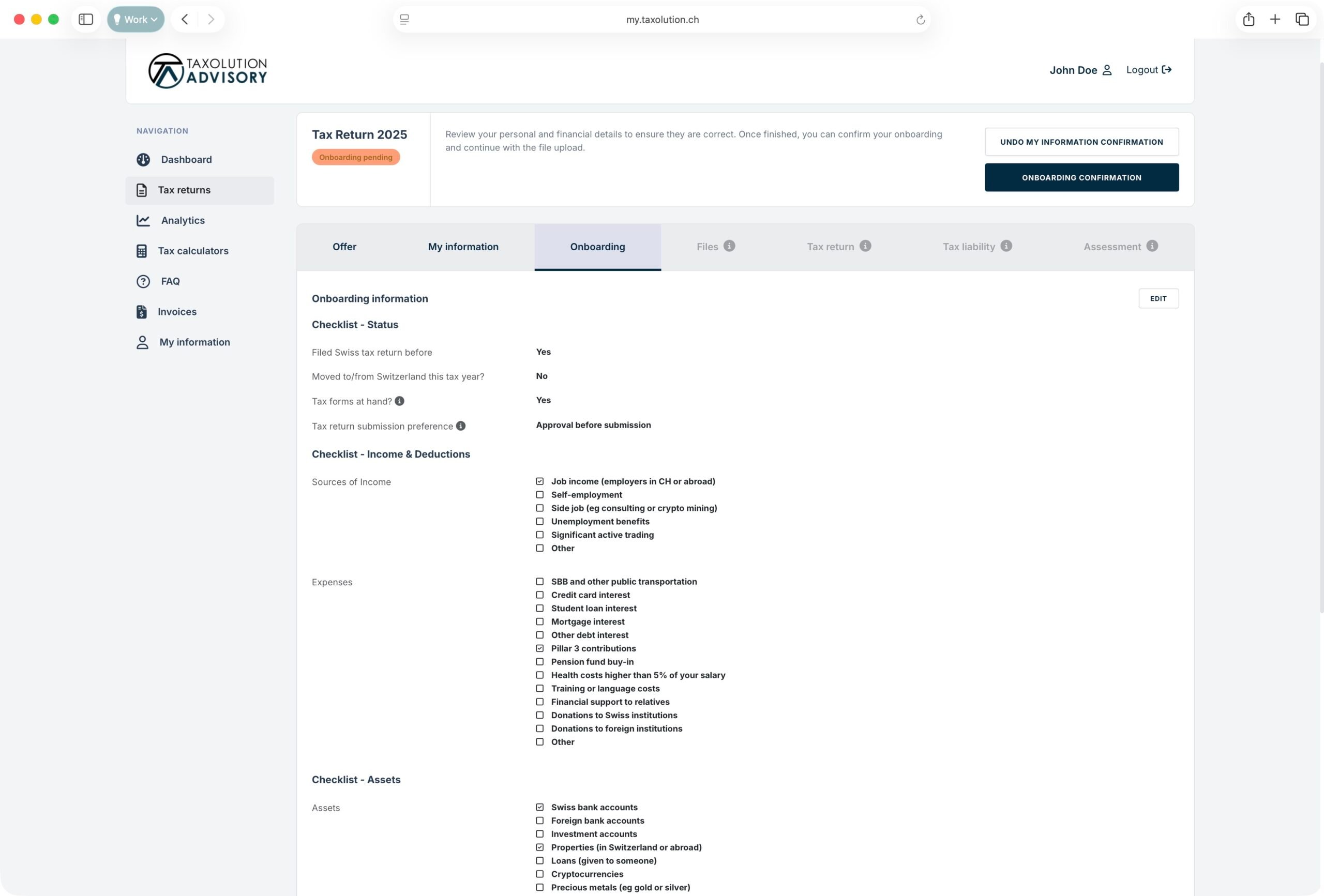

Checklist For Easy Onboarding

Our dynamic checklist allows you to easily modify your financial records.

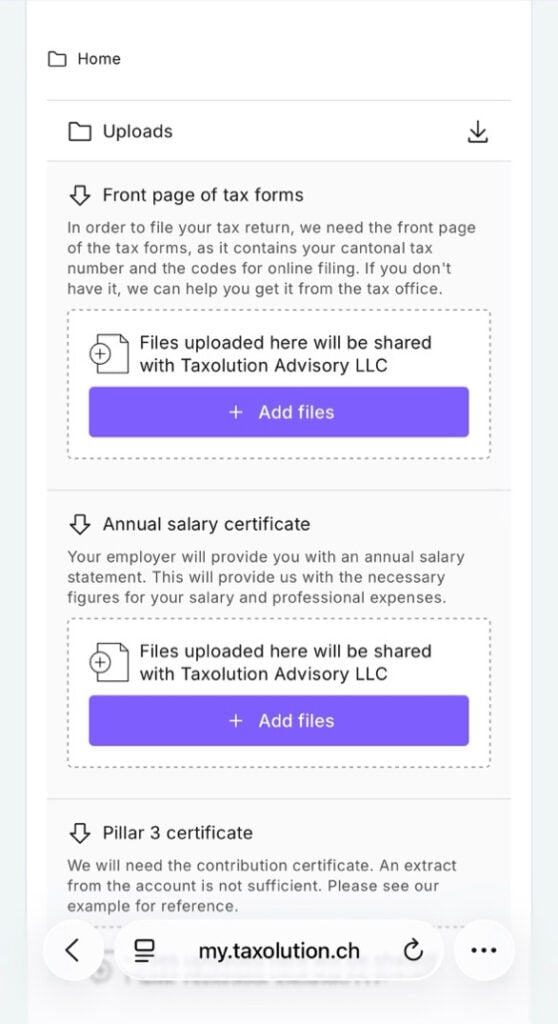

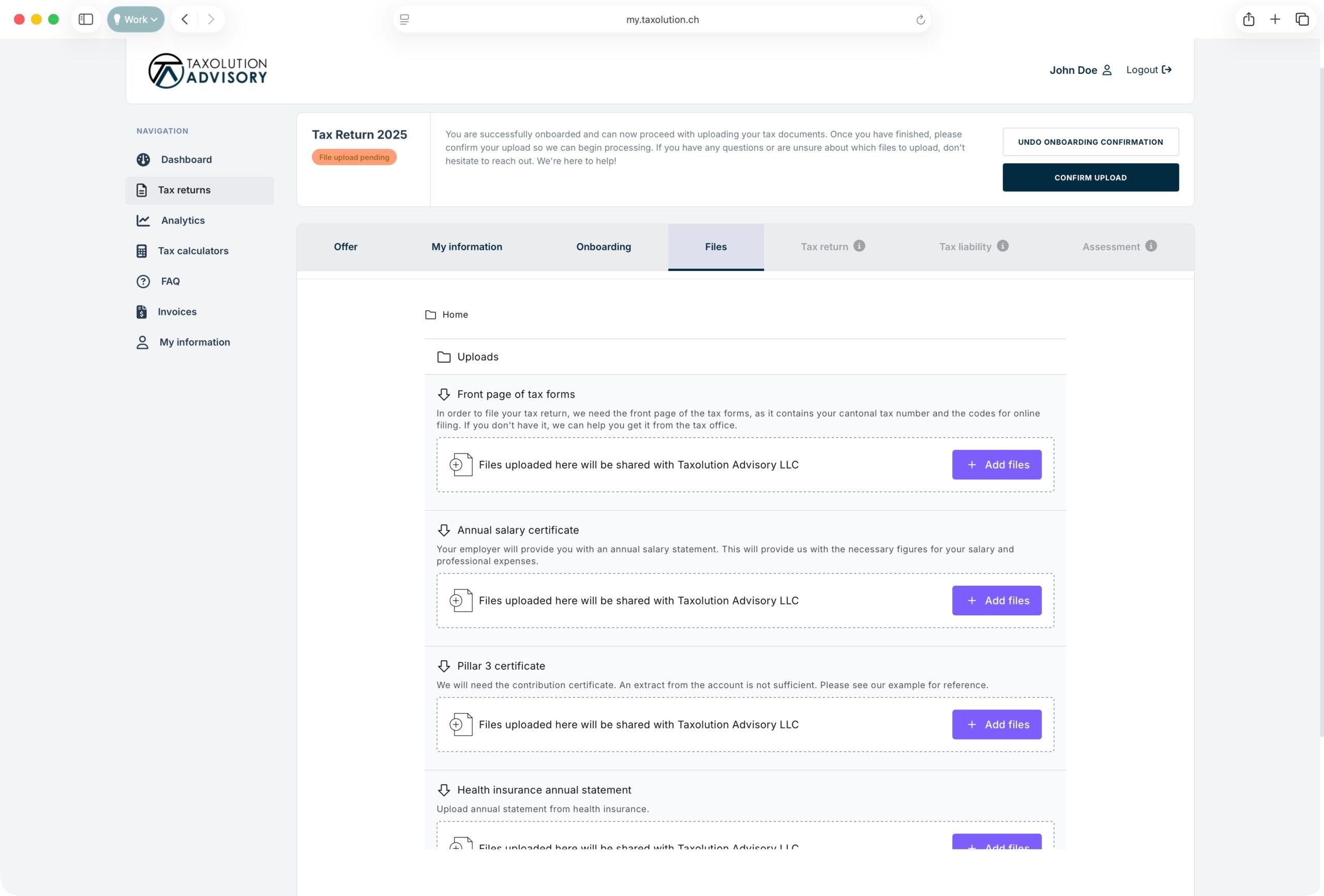

Easy File Upload

Our algorithm optimizes file uploads, requesting only essential files with clear, helpful descriptions.

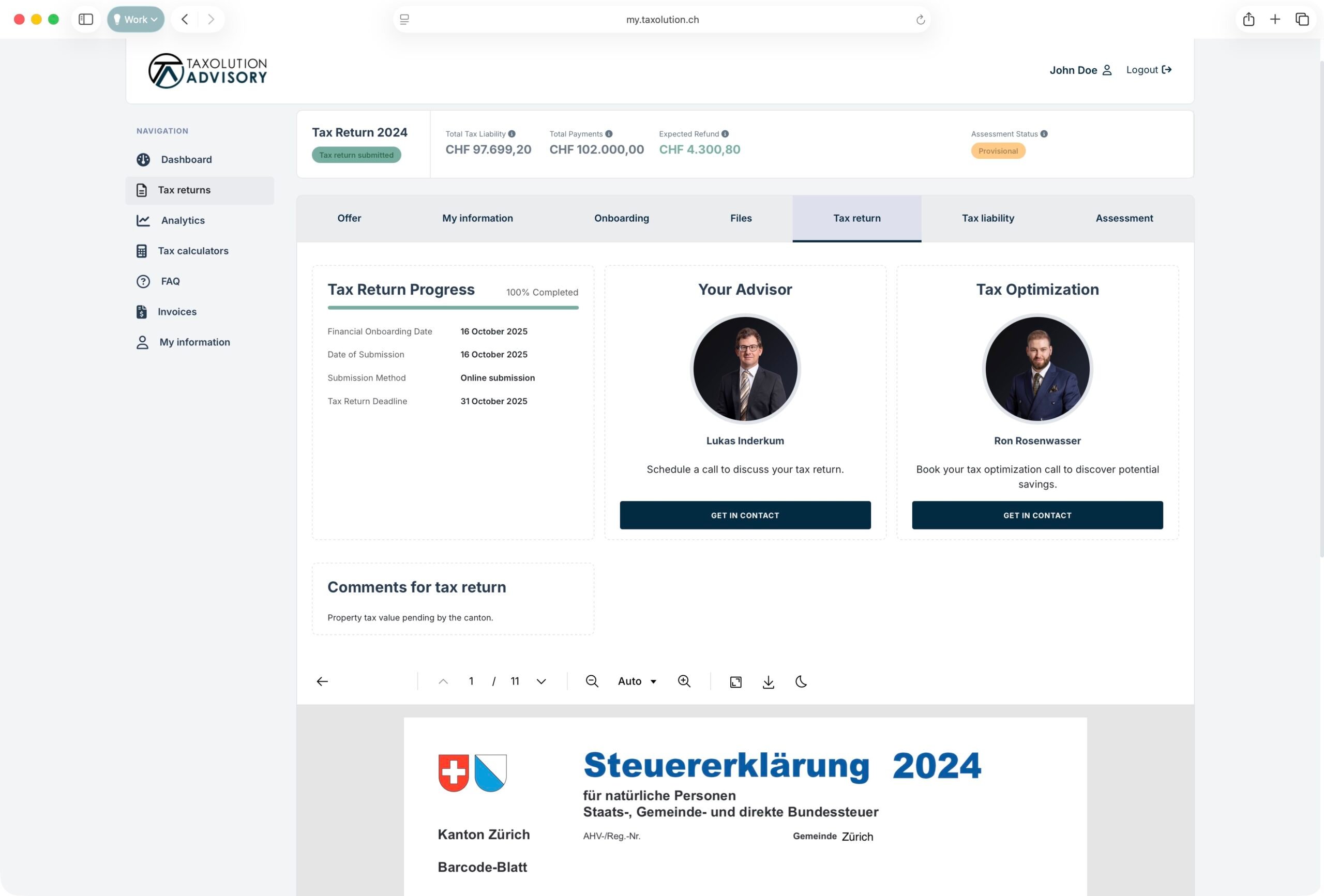

Tax Return Completion

Track your tax return status in MyTaxolution: view timestamps, access the finalized return, and schedule an advisor consultation.

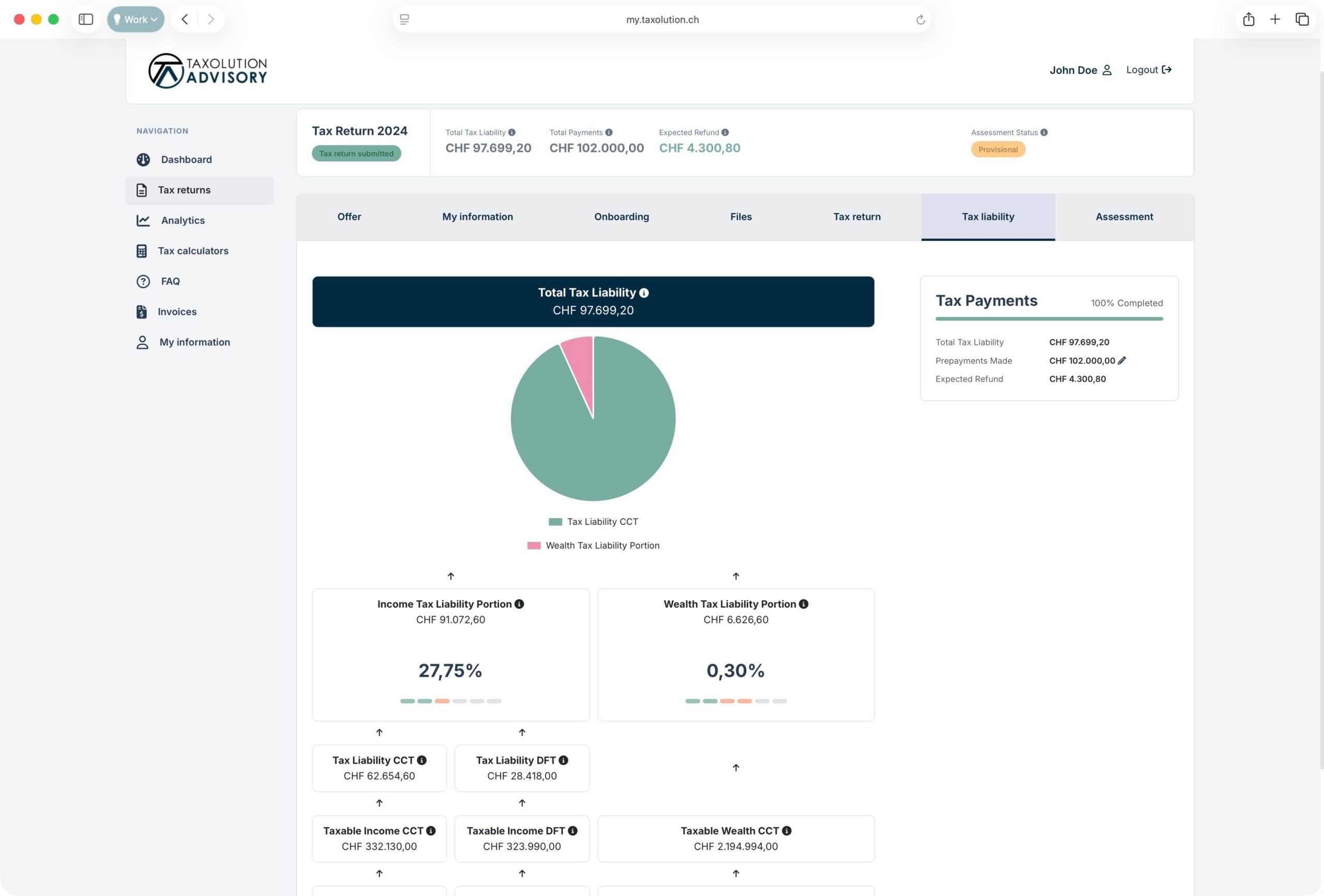

Actually Understand Your Tax Results

We transform your tax return data into a clear, visual guide that simplifies understanding of the Swiss tax system.

Empowering You To Navigate Taxes With Confidence And Simplicity

Our innovative portal bridges the gaps in cantonal digital tax services, offering a seamless and user-friendly platform that empowers individuals to take control of their tax details with confidence and ease.

A Service Built For Expats From The Ground Up

We have created a service that assists expats in navigating the Swiss tax system effortlessly, continuously enhancing it based on client feedback and our increasing number of cases. Central to this development is finding the right balance between digital processes and personalized attention to each client’s situation.

| Features |  | Traditional Fiduciaries | Big-4 |

| Inter-cantonal understanding | |||

| Specialization on expats | |||

| Easy digital onboarding | |||

| Tax portal to manage affairs | |||

| Personalized client experience | |||

| Competitive pricing | |||

| Transparent flat-rate pricing | |||

| Consistent high ratings | |||

| Swift turnarounds | |||

| Tax return available in English | |||

| Proactive tax optimization |

Frequently Asked Questions

What Services Does Taxolution Offer?

Taxolution specializes in providing expats in Switzerland with a modern, digital-first tax service designed for clarity, speed, and ease of use. Our innovative Tax Service for Expats offers a seamless process, ensuring full transparency, high-quality filing, and the convenience of managing multiple tax years through our digital portal—anytime, anywhere.

For those needing guidance on unique tax matters, our Tax Consultations service provides personalized support for issues such as undeclared assets, equity compensation, or cross-border tax challenges, offering clear, actionable solutions.

Beyond tax services, we also support individuals with international work arrangements, offering tailored advice and digital solutions for complex employment models such as ANobAG and EU-employment, ensuring full compliance with Swiss tax regulations.

For businesses, our Business Services provide modern solutions for company incorporations, digital accounting, and administrative support, helping companies streamline operations and focus on growth.

Who Can Benefit From Using Taxolution?

Expats in Switzerland, those with assets or tax obligations in Switzerland or abroad, expats no longer living in Switzerland, individuals with international work arrangements, and businesses seeking assistance with company incorporation, accounting, and administrative tasks can benefit from Taxolution’s tailored services.

Why Do I Need a Tax Advisor in Switzerland?

The Swiss tax system can be overwhelming, especially for expats who often face more complex processes due to international assets, cross-border income, or unique tax obligations. The more complex the case, the greater the need for an expert to navigate the intricacies and ensure compliance. However, we also cater to clients with simpler cases who value the speed, clarity, and optimization our service provides. Whether your situation is straightforward or highly involved, we bring clarity to the situation, maximize savings, and keep everything organized.

What Makes Taxolution Different From Other Tax Advisors?

Our services are designed from the ground up with expats in mind, tailoring every step of the process to address their unique needs and challenges. By combining this specialization with smart digital processes, we deliver better results at higher speeds, ensuring full clarity and convenience.

Can Taxolution Help With Tax Filing If I Am New to Switzerland?

Yes, and we make it effortless! With extensive experience handling a high volume of first-year filings across most cantons, we’ve encountered all kinds of complexities. In many cases, we bring clarity as early as the first call, helping expats understand their situation and the steps ahead. From there, we work with the taxpayer to create a clear, tailored roadmap for their first tax filing, ensuring a smooth and stress-free process.

Latest Blog Posts

Essential guidance on filing, deductions, and avoiding mistakes to simplify the tax process.

Swiss Wealth Tax 2026: What Expats Need to Know

How much wealth tax will you pay in Switzerland? Compare 2026 cantonal rates with our interactive calculator, learn what’s taxable, and see how expats can reduce the bill.

Imputed Rental Value in Switzerland: What Property Owners Need to Know in 2026

In this article, we explain what the imputed rental value is, how it is calculated, and what all you need to take into account when declaring it in your tax return.

The 3-Pillar System in Switzerland in 2026: How Pillar 3a Works, What Changed, and How to Make the Most of It

A complete guide to Pillar 3a for expats and international professionals in Switzerland — contribution limits, tax savings, 3a bank vs securities, retroactive buy-ins, withdrawal tax by canton, and cross-border implications.

Join 1000+ Clients With Our Swiss Tax Service

- Unlock Maximum Tax Savings

- Coverage for Every Canton

- Optimization Recommendations After First Call

- 100% Digital Filing Through Our Tax Portal