Contractor or ANobAG

Contractor Or Anobag – What Is the Difference?

We regularly receive inquiries from people who have recently moved to Switzerland and are now wondering whether they can continue to work with one or more clients abroad. However, according to Swiss law, this working relationship is often interpreted as an employment relationship due to pseudo self-employment, with the result that the clients abroad become employers (from the perspective of Swiss law). This has far-reaching consequences for both parties.

If it is established that the contractor is actually working in a relationship similar to that of an employee, the client is obliged to pay social security contributions for the contractor. However, this becomes problematic if the employer is not domiciled in Switzerland, because then he is not liable to pay contributions here. For such cases, the Swiss social security authority has created the status of ANobAG. In this article, we explain how to proceed in such a constellation and how to avoid pseudo self-employment.

« Pseudo-self-employment is particularly often the case if the contractor in Switzerland works for only one client, is thus financially dependent on this client and is often also bound to the client’s instructions in a special form. »

What Is Pseudo Self-Employment

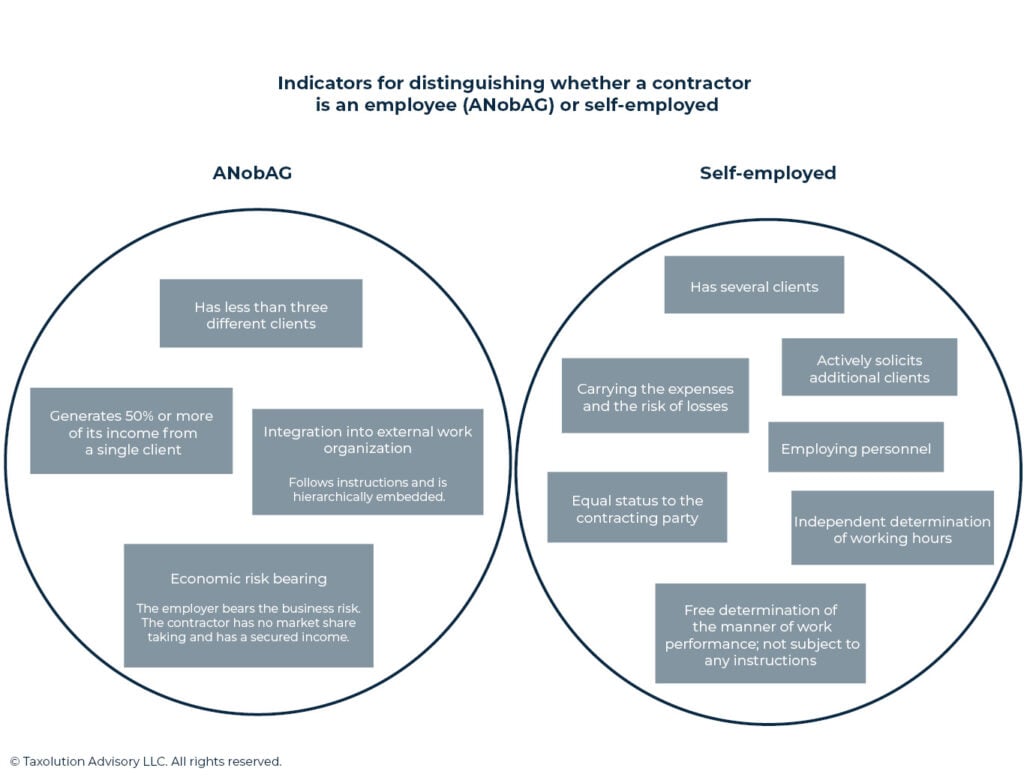

Pseudo self-employment occurs when a contractor acting as an independent contractor works for a client in a framework that resembles an employment relationship. This is particularly often the case if the contractor in Switzerland works for only one client, is thus financially dependent on this client and is often also bound to the client’s instructions in a special form. Sometimes it also happens that a pseudo self-employment is established if the contractor has several clients.

Can a Foreigner Be Self-Employed in Switzerland

A work permit is a must for any foreign national looking to become self-employed and own their own sole proprietorship company in Switzerland. Furthermore, obtaining a permit to work in Switzerland will also depend on whether you have the right skills, what country you are from, and the quotas available. Before they can work, freelancers in Switzerland must have their new status recognized as self-employed by the social insurance scheme. They can apply for this at their canton’s compensation office. The canton will decide whether or not to grant the self-employed status.

How Is Pseudo-Self-Employment Determined in Switzerland?

The cantonal social security office checks whether a pseudo-self-employment exists. Only criteria of an economic nature are used for the assessment. The individual case is always examined, and no general statements can be made as to which category the person concerned will ultimately be placed in. However, if one of the following two criteria is met, the suspicion of pseudo-self-employment is very likely, as a financial dependency can be derived from these criteria:

- the contractor generates 50% or more of its income from a single client

- the contractor has less than three different clients

It is important to note that the following circumstances are NOT indications to eliminate the suspicion of pseudo-self-employment:

- in the business contract, the contractor is expressly designated as self-employed

- the client transfers the responsibility for social insurance to the contractor in the contract

- Presentation of a certificate of self-employment of the contractor issued by the social security office.

- Contractor is registered with AHV and pays regular contributions

What Are the Implications of Pseudo-Self-Employment for the Two Parties?

In principle, it has greater consequences for the client abroad if the contractor is found to be in pseudo-self-employment. Since, from the point of view of the law, this is in fact an employment relationship, the client is obliged to pay a proportion of the social security contributions for the contractor.

For the contractor, the determination of pseudo-self-employment has no financial consequences, but they must either enter into a “proper” employment relationship with their client abroad or otherwise ensure that the determined pseudo-self-employment is dissolved.

The contractor can solve this by either working for several clients so that they are not financially dependent on a single one, or by registering as an ANobAG if it is indeed an employment relationship with the client abroad.

What is ANobAG

How Does ANobAG Work

The abbreviation ANobAG stands for employees without a contributory employer. Employers abroad who do not have a place of business in Switzerland are not subject to social security contributions here. What an ANobAG setup does is making sure the employee can still work for the employer by allowing him/her to handle all the administrative work and pay the contributions directly with the social security office in Switzerland.

This means that the employee pays all contributions to AHV/IV/EO (old-age and survivors’ insurance / disability insurance / income replacement scheme) and unemployment insurance (ALV), as well as the family allowance. The employer’s contribution is only payable by the employer in certain cases.

The purpose of this regulation is to ensure that the Swiss social security system has a contribution debtor in Switzerland. Thus, if the employer does not have a registered office or permanent establishment in Switzerland and is therefore not liable to pay contributions, the employee residing in Switzerland remains the only debtor. See also our Article FAQ work in Switzerland – employer abroad.

What Should Be Considered When Registering as An Anobag?

If you have an employment relationship that requires you to register as an ANobAG, you must register this immediately with the compensation office in your canton of residence. If you wait too long, this may result in possible fines. In addition, you will have more work to do when it comes to settling your payable social security contributions, which you will then have to pay in arrears at a later date.

Depending on whether your employer is based in the EU/EFTA foreign country or a third contry, you and your employer have different obligations.

Employers in EU/EFTA Foreign Countries

Switzerland has concluded an agreement with the EU/EFTA states which states that employers who do not have a place of business in Switzerland but who employ workers there are liable to pay contributions in Switzerland.

As an employee, you then agree to pay the employer’s social security contributions yourself. The employer then transfers the contributions to you in addition to your salary and you pay them to the compensation office.

In addition, you must take out accident insurance (UVG) and join the occupational pension scheme (BVG).

Employers Outside the EU/EFTA Area

Switzerland has no agreement with third countries that requires employers to pay social security contributions for their employees in Switzerland.

In this case, you must pay both your own and the employer’s contribution in full.

In addition, you must also take out accident insurance in this case. The connection to the occupational pension plan does not apply but can be taken out voluntarily.

What Are the Contribution Rates For ANobAG?

The employee and employer contribution rates apply to ANobAG, whereby some contributions vary from canton to canton or depending on the contract concluded. If the ANobAG works for an employer in an EU/EFTA country, the bottom line is that only half of the contributions have to be paid out of pocket, since the employer transfers his share with the salary.

| Social Security | Contribution Rate (Employee + Employer Contribution) |

| AHV/IV/EO | 10,6% |

| ALV (up to CHF 148,200) | 2,2% |

| ALV (from CHF 148,201) | 1,0% |

| Family allowance | varies depending on the canton (1.1% – 2.83%) |

| Administrative expenses | max. 3% of the AHV contribution |

| Accident insurance | Varies depending on the contract |

| occupational pension plan (BVG) | Varies depending on the contract |

(valid from 01.01.2021)

We Help You Further

Due to the complex set of regulations and various bilateral agreements with other countries, it is not always easy to assess for the individual case whether an employee must be registered as an ANobAG or not. We will therefore be happy to help you assess your case and advise you on the options available to you.